The Longevity Economy

Hidden in the newsblur of politics and the pandemic is the growth of a longevity economy. It’s a product of increasing lifespan, a blind spot among the young and corporations, and a groundswell of spending to stay fit, healthy, and defy the stereotype of what you look like in your 70’s, 80’s, or 90’s.

US population is aging. Between 1920 and 2020 lifespans doubled. In the years ahead that trend accelerates. According to AARP 50+ Americans will number 157.3 million or 41% of the population by 2050. But don’t try to persuade a growing percentage of over-65 Americans that they should just accept retirement, inactivity, and creeping physical and mental decline. Many individuals are in good physical condition and want to maintain it. There’s a hidden culture and sub-economy that is coalescing around health, continuation in the workforce, and even starting new enterprises.

The numbers will be big. Senior impact on the GDP will triple by 2050. $28.2 TRILLION with a T. $19.2 trillion of that will be wages and salaries. Up from $5.7 trillion in 2018.

When I work with clients and industries dealing with labor shortages the execs move to the edge of their seats when I get into seniors reentering the workforce. Granted, these are not people who will hump drywall into place in construction. But they possess work habit and ethic, have developed relationship skills, and are perfect in customer-facing settings, teamwork projects, and mentoring situations.

In a 2021 “New Rules” closing segment Bill Maher talked about how Joe Biden wasn’t offering any “feeble targets” for comedians like him. Maher riffed on the fact that Biden was old and wise, getting things done, and leveraging his wisdom to deftly gain a 60% approval rating and the most effective first term for any President. He’s a poster-guy for the leading edge of boomer seniors – a large cohort that could solve a lot of hiring issues in the future.

One term for the return to the workforce by seniors is “Revolving Retirement.” Older staff retire, sharpen their golf game or get bored with word-working, and then look to get back into structured activity. It’s not always in a work setting. Some volunteer or even act as non-profit entrepreneurs. But the majority work or semi-work. It’s a formula that even encourages longer lifespans as statistics show. Oregon State University researchers started picking up the trend in 2010 that delaying retirement led to double-digit increases in life expectancy.

So what are we talking about here?

There are two issues to longevity. One is the absolute lifespan – how long could we actually live? Another is “productive lifespan” - how long can we voluntarily stay active – working, contributing to society, remaining “vital,” to our family, friends and others?

There are two schools of thought here. One is the scientific observation that, other than rare outliers, the oldest humans have lived to so far is around 115. But actuaries, who study the same statistics but calculate odds of surviving another year, say that at 105 an older person has a 50% chance of surviving the next year. It’s the same odds at 106, 107, 108 and even later years. The actuaries say there isn’t a limit that we’ve seen yet.

But the concept of surviving well into our 100’s is intriguing. How do we plan for income, healthcare, housing, family, fun, travel, and making life livable? What do we do about economic cycles including inflation? Government social support programs?

The industries that crack the code on this enlarging market segment stand to benefit. Financial services companies instead of hand-wringing about an aging customer base could build bespoke plans and products for this segment. Temporary agencies could attract a cadre of seniors to place in customer-facing, analytical, or interactive environments. Some companies are already retaining retirees for coaching, counseling, and mentoring teams by extending healthcare benefits. Government could re-envision national service programs to recruit seniors alongside the youth to address the needs of society. Marketers can tap into the segment to sell longevity-oriented physical health programs, financial advice, and something better than a reverse mortgage.

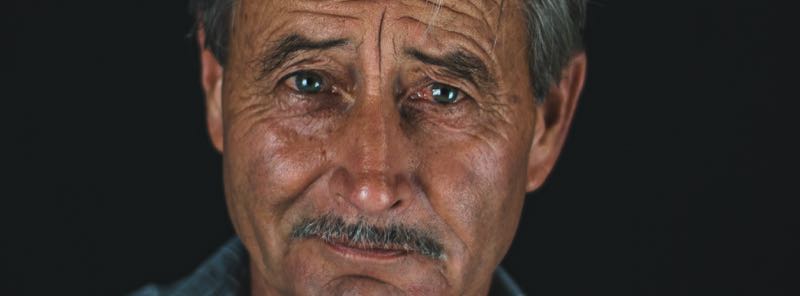

Image © Bob Treadway, 2021. All rights reserved.

Photo by Luke Southern on Unsplash

US population is aging. Between 1920 and 2020 lifespans doubled. In the years ahead that trend accelerates. According to AARP 50+ Americans will number 157.3 million or 41% of the population by 2050. But don’t try to persuade a growing percentage of over-65 Americans that they should just accept retirement, inactivity, and creeping physical and mental decline. Many individuals are in good physical condition and want to maintain it. There’s a hidden culture and sub-economy that is coalescing around health, continuation in the workforce, and even starting new enterprises.

The numbers will be big. Senior impact on the GDP will triple by 2050. $28.2 TRILLION with a T. $19.2 trillion of that will be wages and salaries. Up from $5.7 trillion in 2018.

When I work with clients and industries dealing with labor shortages the execs move to the edge of their seats when I get into seniors reentering the workforce. Granted, these are not people who will hump drywall into place in construction. But they possess work habit and ethic, have developed relationship skills, and are perfect in customer-facing settings, teamwork projects, and mentoring situations.

In a 2021 “New Rules” closing segment Bill Maher talked about how Joe Biden wasn’t offering any “feeble targets” for comedians like him. Maher riffed on the fact that Biden was old and wise, getting things done, and leveraging his wisdom to deftly gain a 60% approval rating and the most effective first term for any President. He’s a poster-guy for the leading edge of boomer seniors – a large cohort that could solve a lot of hiring issues in the future.

One term for the return to the workforce by seniors is “Revolving Retirement.” Older staff retire, sharpen their golf game or get bored with word-working, and then look to get back into structured activity. It’s not always in a work setting. Some volunteer or even act as non-profit entrepreneurs. But the majority work or semi-work. It’s a formula that even encourages longer lifespans as statistics show. Oregon State University researchers started picking up the trend in 2010 that delaying retirement led to double-digit increases in life expectancy.

So what are we talking about here?

There are two issues to longevity. One is the absolute lifespan – how long could we actually live? Another is “productive lifespan” - how long can we voluntarily stay active – working, contributing to society, remaining “vital,” to our family, friends and others?

There are two schools of thought here. One is the scientific observation that, other than rare outliers, the oldest humans have lived to so far is around 115. But actuaries, who study the same statistics but calculate odds of surviving another year, say that at 105 an older person has a 50% chance of surviving the next year. It’s the same odds at 106, 107, 108 and even later years. The actuaries say there isn’t a limit that we’ve seen yet.

But the concept of surviving well into our 100’s is intriguing. How do we plan for income, healthcare, housing, family, fun, travel, and making life livable? What do we do about economic cycles including inflation? Government social support programs?

The industries that crack the code on this enlarging market segment stand to benefit. Financial services companies instead of hand-wringing about an aging customer base could build bespoke plans and products for this segment. Temporary agencies could attract a cadre of seniors to place in customer-facing, analytical, or interactive environments. Some companies are already retaining retirees for coaching, counseling, and mentoring teams by extending healthcare benefits. Government could re-envision national service programs to recruit seniors alongside the youth to address the needs of society. Marketers can tap into the segment to sell longevity-oriented physical health programs, financial advice, and something better than a reverse mortgage.

Image © Bob Treadway, 2021. All rights reserved.

Photo by Luke Southern on Unsplash